Average House Rent (Info Guide With States)

Are you curious about the monthly rent for a house in the U.S? As 44.1 million U.S residents are renters, so many people like you are looking for how much they have to pay for a house for rent in the U.S prime locations.

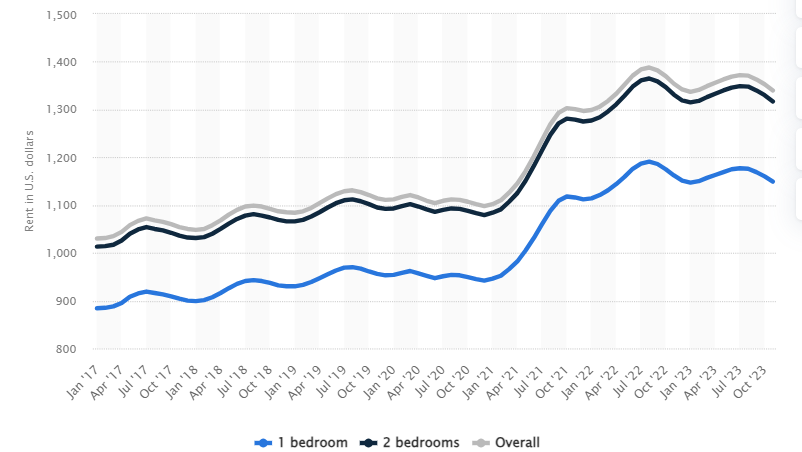

The average monthly rent for all apartment types in the United States rose substantially in 2021. In 2023, rents began to soften, with November 2023 seeing a monthly rent for a two-bedroom apartment amounting to 1,317 U.S. dollars, down from 1,331 U.S. dollars a year ago.

In this guide we will discuss the house rent in the U.S and the average size of the apartment in the U.S. Then we will discuss the house rents with U.S states along with the apartment sizes.

Then we will share information with you about the housing affordability index. At the end of this guide we walk you through the change in FHFA states house price indexes dividing in 8 parts for your better understanding.

Average House Rent in the U.S

The location, house size and quality decide what should be the house rent. In the U.S average house rent is $1715 in 2024.

The cost may be high because some people like to buy luxury houses. And some people are looking for a cheap rate house on rent. These are not furnished and not at prime locations in the U.S.

As when we live at a place for a long time, say more than 5 years, you are used to the house or apartment where you lived. A natural interest has been developed for houses.

Quality of the house sometimes is extraordinary but when you are going to take it for rent you have to do many changes by yourself after you take the house on rent.

Its condition is very low, sometimes you have to paint all the walls you have to remove dest. You need to call a plumber to make the washrooms ready for use.

So before you are going to take a house on rent in the U.S please take care of the above factors.

Average Apartment Size in U.S

The average apartment size in the United States is 899 square feet, though this figure can vary significantly based on the unit type. Studio apartments, the smallest and most cost-effective option, typically fall below this average.

One-bedroom apartments generally align more closely with the median size, whereas two-bedroom and three-bedroom apartments offer more spacious living areas, catering to those seeking larger accommodations.

Both budget-friendly and luxury options are available for houses and apartments, providing a range of choices to suit different preferences and financial capacities.

Average Rent in the U.S. by state with Apartment Size

| State | Average Rent | Average Apartment Size |

| Texas | $1,441 | 880 sq. ft. |

| California | $2,521 | 851 sq. ft. |

| Colorado | $1,863 | 872 sq. ft. |

| New Mexico | $1,326 | 828 sq. ft. |

| New York | $2,673 | 841 sq. ft. |

| North Carolina | $1,510 | 960 sq. ft. |

| Idaho | $1,547 | 913 sq. ft. |

| Connecticut | $1,926 | 893 sq. ft. |

| Delaware | $1,587 | 916 sq. ft. |

| District of Columbia | $2,387 | 747 sq. ft. |

| Florida | $1,939 | 970 sq. ft. |

| Georgia | $1,602 | 1,016 sq. ft. |

| Hawaii | $2,522 | 847 sq. ft. |

| New Hampshire | $1,975 | 877 sq. ft. |

| New Jersey | $2,236 | 858 sq. ft. |

| Illinois | $1,874 | 835 sq. ft. |

| Indiana | $1,253 | 903 sq. ft. |

| Iowa | $1,185 | 894 sq. ft. |

| Kansas | $1,193 | 903 sq. ft. |

| Kentucky | $1,234 | 929 sq. ft. |

| Louisiana | $1,199 | 914 sq. ft. |

| Maine | $1,851 | 843 sq. ft. |

| Maryland | $1,811 | 903 sq. ft. |

| Massachusetts | $2,714 | 888 sq. ft. |

| Michigan | $1,291 | 917 sq. ft. |

| Minnesota | $1,515 | 886 sq. ft. |

| Mississippi | $1,278 | 1,014 sq. ft. |

| Missouri | $1,242 | 896 sq. ft. |

| Montana | $1,534 | 866 sq. ft. |

| Nebraska | $1,221 | 932 sq. ft. |

| Nevada | $1,496 | 900 sq. ft. |

| North Dakota | $1,048 | 967 sq. ft. |

| Ohio | $1,230 | 896 sq. ft. |

| Oklahoma | $1,001 | 856 sq. ft. |

| Oregon | $1,704 | 852 sq. ft. |

| Pennsylvania | $1,660 | 887 sq. ft. |

| Rhode Island | $1,992 | 921 sq. ft. |

| South Carolina | $1,564 | 998 sq. ft. |

| South Dakota | $1,106 | 902 sq. ft. |

| Tennessee | $1,465 | 949 sq. ft. |

| Alabama | $1,265 | 984 sq. ft. |

| Alaska | $1,422 | 703 sq. ft. |

| Arizona | $1,581 | 845 sq. ft. |

| Arkansas | $1,067 | 895 sq. ft. |

| Arkansas | $1,067 | 895 sq. ft. |

| Utah | $1,592 | 918 sq. ft. |

| Vermont | $1,936 | 813 sq. ft. |

| Virginia | $1,892 | 915 sq. ft. |

| Washington | $1,976 | 835 sq. ft. |

| West Virginia | $1,257 | 989 sq. ft. |

| Wisconsin | $1,491 | 902 sq. ft. |

| Wyoming | $1,120 | 877 sq. ft. |

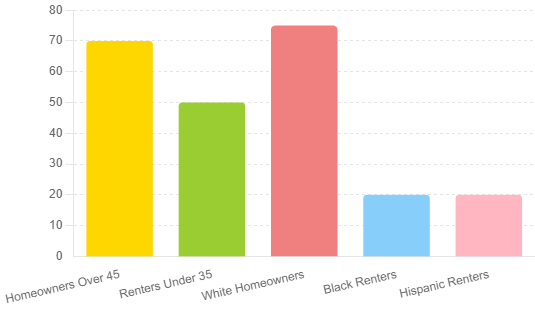

Renters and Homeowners by Race

| Homeowners | Renters | |

| White | 75.10% | 51.80% |

| Asian | 4.70% | 5.40% |

| Hispanic | 10.20% | 19.70% |

| Black | 8.20% | 20.30% |

Quarterly Housing Affordability Index

The median asking rent of $1,462 monthly translates to an annual cost of $17,544. In contrast, with a median asking home sales price of $319,000, purchasing a typical home is more than 18 times more expensive annually than renting.

This significant disparity underscores the financial challenge many renters face in affording homeownership without substantial savings for a down payment.

| Period | Median Price | Median Family Income | Monthly P&I Payment | Composite Affordability Index |

| Q1 ’22 | $372,000 | $85,953 | $1,397 | 128.2 |

| Q4 ’22 | $378,400 | $90,234 | $1,967 | 95.5 |

| Q3 ’22 | $398,100 | $88,250 | $1,838 | 100 |

| Q2 ’22 | $412,700 | $87,181 | $1,837 | 98.8 |

| Q1 ’23 | $371,200 | $91,919 | $1,859 | 102.1 |

Change in FHFA State House Price Indexes

Now we will discuss the change in FHFA state vise for house prices indexes. Below is a complete guide for you in table for better understanding about 1-year change (%) and then next column is 5-Year change (%), you guys can compare these both changes.

We will go through the regional monthly gains and 12 month timescale changes. Then we will walk you through the median existing home sales and also a table for you about the mortgage interest rates.

At the end of this section we discuss homebuyers in U.S what are their purchasing power and what is average monthly mortgage payments.

Let’s delve into it

State-wise Changes

| State | 1-Year Change (%) | 5-Year Change (%) |

| South Carolina | 9.53 | 70.84 |

| North Carolina | 9.41 | 75.50 |

| Maine | 8.94 | 76.41 |

| Vermont | 8.82 | 63.80 |

Regional Monthly Gains

| Region | Monthly Change (%) (April to May) |

| New England | -0.5 |

| Pacific Division | 1.7 |

12-Month Timescale Changes

| Region | 12-Month Change (%) |

| Mountain Division | -2.7 |

| East North Central Division | 5.5 |

Median Existing-Home Sales Price

| Metric | Value |

| Median existing-home sales price (June 2023) | $410,200 |

| Second-highest median price since | January 1999 |

Mortgage Interest Rates

| Time Period | Interest Rate (%) |

| During the pandemic | 3 |

| 2023 | 7 |

Homebuyer Purchasing Power

| Time Period | Home Price Affordability | Monthly Mortgage Budget ($3,000) |

| July 2022 | $510,000 | $3,000 |

| February 2023 | $480,000 | $3,000 |

| July 2023 | $450,000 | $3,000 |

Average Monthly Mortgage Payments

| Mortgage Type | Monthly Payment ($) |

| 30-year fixed-rate mortgage | $2,823 |

| 15-year fixed-rate mortgage | $3,724 |

Property Tax Rates

| State | Property Tax Rate (%) |

| New Jersey | 2.47 |

| Illinois | 2.30 |

| Connecticut | 2.11 |

| New Hampshire | 2.05 |

| Vermont | 2.02 |

| Hawaii | 0.29 |

| Alabama | 0.33 |

| Colorado | 0.49 |

| Nevada | 0.53 |

| Louisiana | 0.55 |