House Rent Receipt Sample: How to Write it

Are you struggling with how to create a proper house rent receipt sample for your tenants? Ensuring you have a reliable and accurate rent receipt is crucial for both landlords and tenants.

This simple document can save you from potential disputes and maintain clear financial records. Let’s dive into the essential steps to create a house rent receipt that will keep both parties satisfied and compliant with legal requirements.

What is a House Rent Receipt?

A house rent receipt is a document that provides proof of payment made by a tenant to their landlord. It typically includes details such as the date of payment, the amount paid, the rental period, the property address, the tenant’s name, and the method of payment. This receipt is essential for record-keeping and can help resolve any disputes regarding rent payments.

4 Steps: How to Write a Receipt for House Rent

Creating a detailed and accurate rent receipt is simple if you follow these steps:

Step 1. Collect / Pay Rent

The process starts with the tenant paying the rent according to the rental agreement. The payment can be in cash, check, money order, or even through electronic means.

Step 2. Write the Receipt

Here’s a detailed look at how to fill out each section of the rent receipt:

| Field | Description |

| Date of Payment | Write the date on which you received the rent. This should be the actual date of the transaction. |

| Tenant’s Name | Include the full name of the tenant who made the payment. |

| Property Address | Specify the address of the rental property for which the rent is being paid. |

| Amount Paid | Enter the exact amount of rent paid. Both numerical and written formats can be used. |

| Rental Period | State the rental period that the payment covers, such as “January 2024”. |

| Payment Method | Indicate how the rent was paid (cash, check, money order, etc.). |

| Landlord’s Signature | The landlord must sign the receipt to validate i |

Step 3. Landlord’s Signature

The landlord’s signature is crucial as it legally acknowledges the receipt of the payment.

Step 4. Keeping the Receipt

Both parties should keep a copy of the rent receipt. The tenant should store it safely in case there are any future disputes about rent payments.

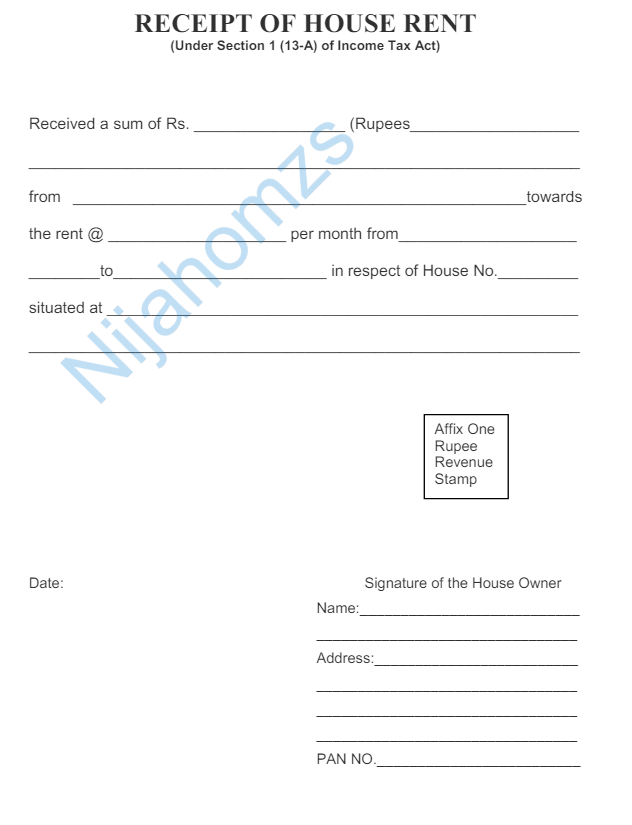

House Rent Receipt Sample

Here is a sample template you can use:

Date: ____________________

Received from: ____________________ (Tenant’s Full Name)

Property Address: ____________________

Amount Paid: $____________________

For Rent of the Month: ____________________ (e.g., January 2024)

Payment Method: [ ] Cash [ ] Check [ ] Money Order [ ] Other: __________

Landlord’s Signature: ____________________

Benefits of Keeping Rent Receipts

Keeping detailed rent receipts is beneficial for several reasons:

- Record Keeping: They help maintain an accurate record of all transactions.

- Legal Protection: Some states require receipts for rent payments by law.

- Dispute Resolution: They provide proof of payment and can help resolve disputes between landlords and tenants.

- Tax Purposes: Rent receipts can be useful during tax preparation for both parties.

How to Accept Rent Online

Accepting rent payments online has become increasingly popular due to its convenience. Here’s how you can set it up:

1. Signup with a Website

Choose a website like Apartments.com, Avail.co, or Zillow, and sign up. Include your property details and get verified.

| Websites | ACH Fee | Credit Card Fee | Monthly Subscription |

| Apartments.com | $0 | 2.75% | $0 |

| Avail.co | $2.50 | 3.50% | $0 |

| ClickPay.com | $0 | 2.95% | $0 |

| eRentPayment.com | $3 | N/A | $0 |

| PayYourRent.com | $2.50 | 2.95% | Based on number of units |

| RentPayment.com | $4.95 | 2.95% | $0 |

| Zillow | $0 | 2.95% | $0 |

2. Alert Your Tenants

Inform your tenants about the new online payment option. This can often be done without any fees for ACH payments, making it convenient for tenants.

Wrapping Up

Creating and maintaining a proper house rent receipt sample is essential for smooth rental management. Following these simple steps to write a house rent receipt ensures clarity and legal compliance for both landlords and tenants.

From documenting payment details to keeping thorough records, a well-crafted receipt can prevent disputes, aid in tax preparation, and provide peace of mind.

Whether you prefer traditional handwritten receipts or modern online payment methods, these practices will help you maintain clear, accurate financial records and foster a positive rental experience.

FAQs

Do rent receipts need to be signed?

Yes, the landlord’s signature is essential as it provides legal proof of payment.

Is it necessary to submit rent receipts for taxes?

A: Yes, rental income must be reported on your tax return, and rent receipts are excellent documentation for this.

Is a handwritten receipt legal?

Yes, as long as it is legible and contains all the pertinent information.

What makes a receipt invalid?

A receipt without a transaction date, amount, landlord’s name, or purpose of payment is invalid.

Should receipts be given for all payments?

Yes, including rent, security deposits, late payments, and partial payments.

Creating and maintaining proper rent receipts is essential for smooth rental management. Ensure you follow these guidelines to keep both you and your tenants satisfied and legally compliant.